By Jim O’Neal

It may come as no surprise to learn that virtually all the major cities in California were incorporated in the same year. 1850 was also the year California became the 31st state to join the United States. It is now the most populous state and supports a $3 trillion economy, which ranks No. 5 in the world … larger than Great Britain. However, you probably don’t know that, in terms of land area, the three largest cities are Los Angeles, San Diego and (surprisingly) California City.

This large chunk of land was formed in the boomlet following World War 2 with the intent of rivalling Los Angeles. Southern California was flourishing due to temperate weather, Pacific Ocean beaches and nearby mountains. It seemed logical that with a large influx of people, all that was lacking were lots of affordable housing, automobiles, streets, freeways and plenty of water to drink and as irrigation for the orange groves.

An ambitious land developer spotted this unique opportunity and bought 82,000 acres of prime California City land just north of the SoCal basin. He commissioned a high-power, architectural master-plan community with detailed maps of blocks, lots and streets. Next was hiring a small army of 1,300 salesmen to promote land sales to individuals, while building a 26-acre artificial lake, two golf courses and a four-story Holiday Inn.

This was land speculation on a grand scale; they sold 50,000 lots for $100 million before the market dried up. Some reports claim that only 175 new homes were actually built. The fundamental reason was that Southern California land development primarily evolved south along the coastline toward San Diego and the prime ocean-front property in Malibu, Long Beach and Orange County. Although the scheme failed, California City was finally incorporated in 1965. Today, the 15,000 inhabitants, many from Edwards Air Force base, are sprinkled liberally over 204 square miles.

A prominent No. 4 on the list is San Jose, which narrowly escaped being destroyed in a 1906 earthquake that nearly leveled nearby San Francisco. When we lived there (1968-71), it was a small, idyllic oasis with plum trees growing in undeveloped lots in the shadow of the Santa Cruz Mountains. There were nice beaches an hour away and for $14.15, PSA would fly you 400 miles to LAX in 45 minutes. In addition to the short drive to San Francisco with all its wonders, Lake Tahoe offered gambling, except when it snowed on the Sierra Nevada, a mere 200 miles away.

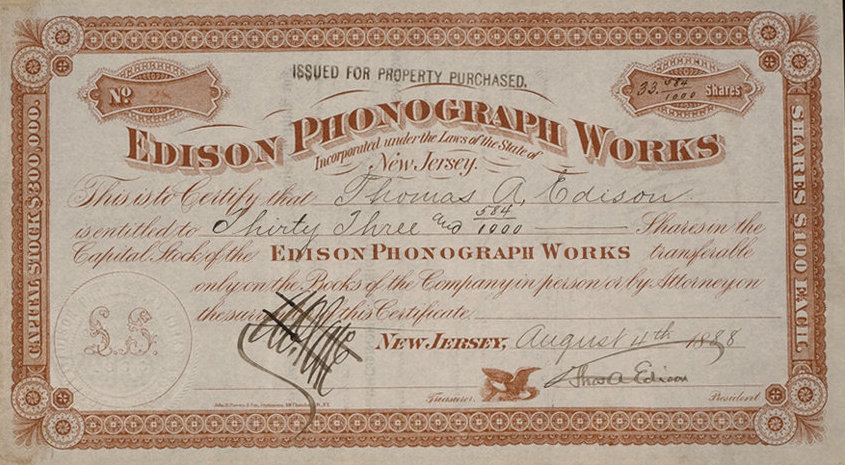

Nobody dreamed that the miracle of Silicon Valley was on the horizon and the enormous impact of the Internet would result in the boom-bust of the dot.com era in the late 1990s. The stock market was up 400% and then down 80%, wiping out most of the gains. However, post 2002, and the proliferation of the personal computer, there was another technology revolution that would create more wealth than anyplace in the history of the world.

Apple, Google, Facebook, eBay, Intel, Cisco and Instagram are at the core of a technological society that has revolutionized our economy and communications, our lives and, by extension, the world. Smart phones, search engines and social-media giants – plus a community of 2,000 tech firms and venture capitalists – have generated enormous fortunes. Electric vehicles have morphed into driverless cars and trucks that will result in more creative destruction. AI and robotics will obsolete large swaths of production and elevate privacy and anti-trust concerns that will rival early 20th century government action to break up trusts.

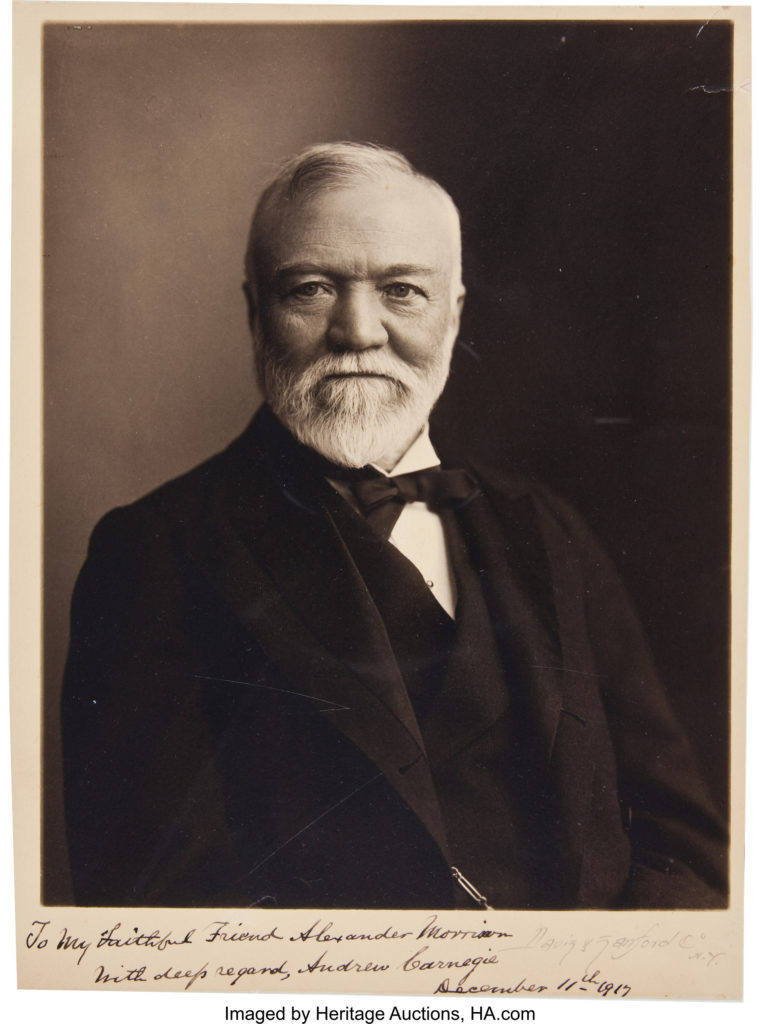

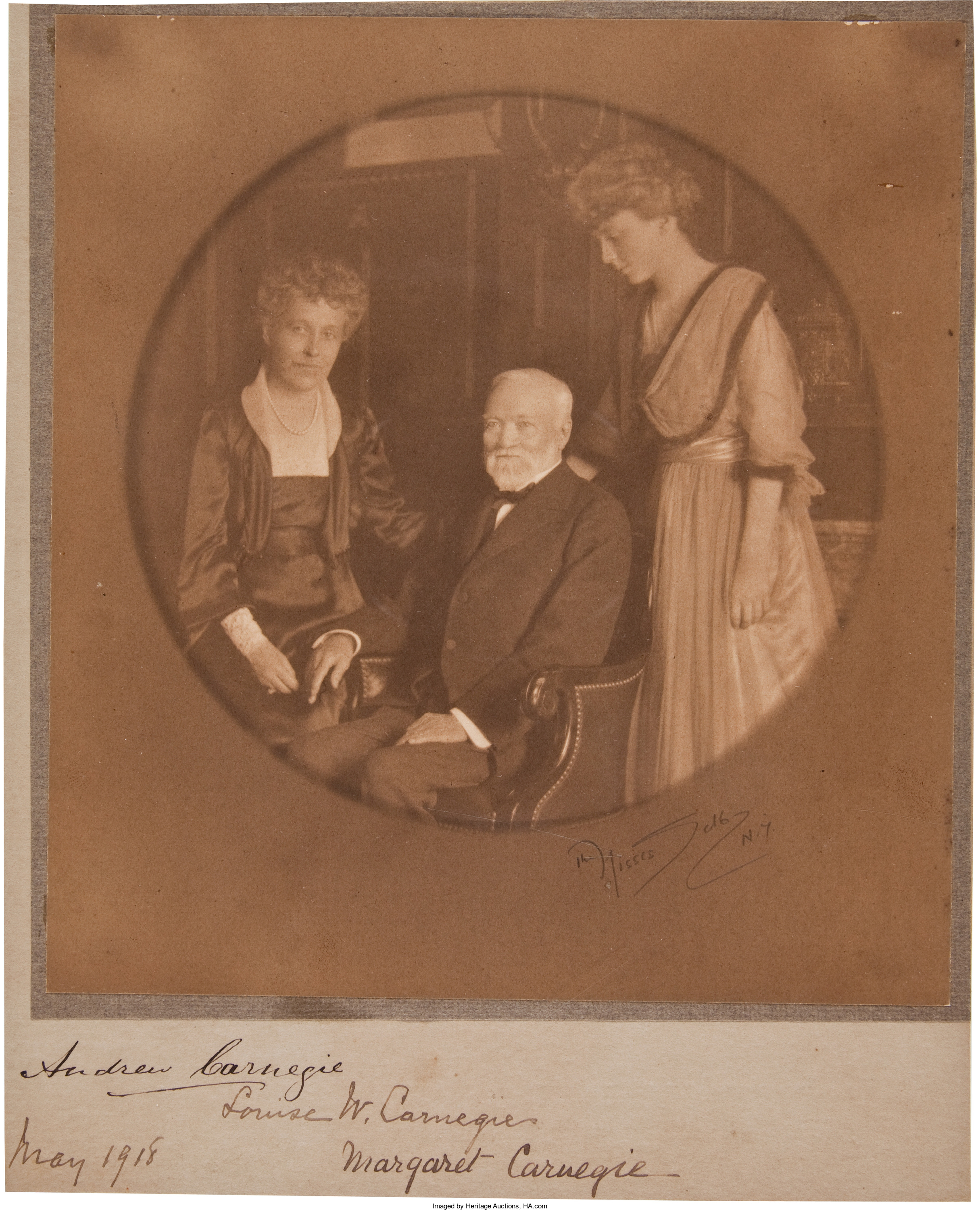

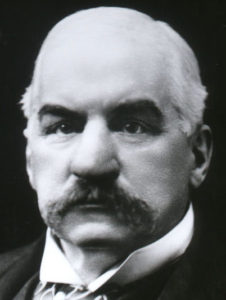

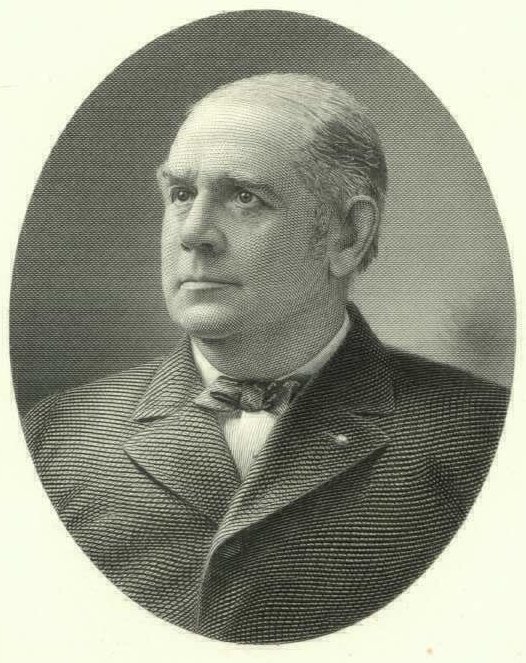

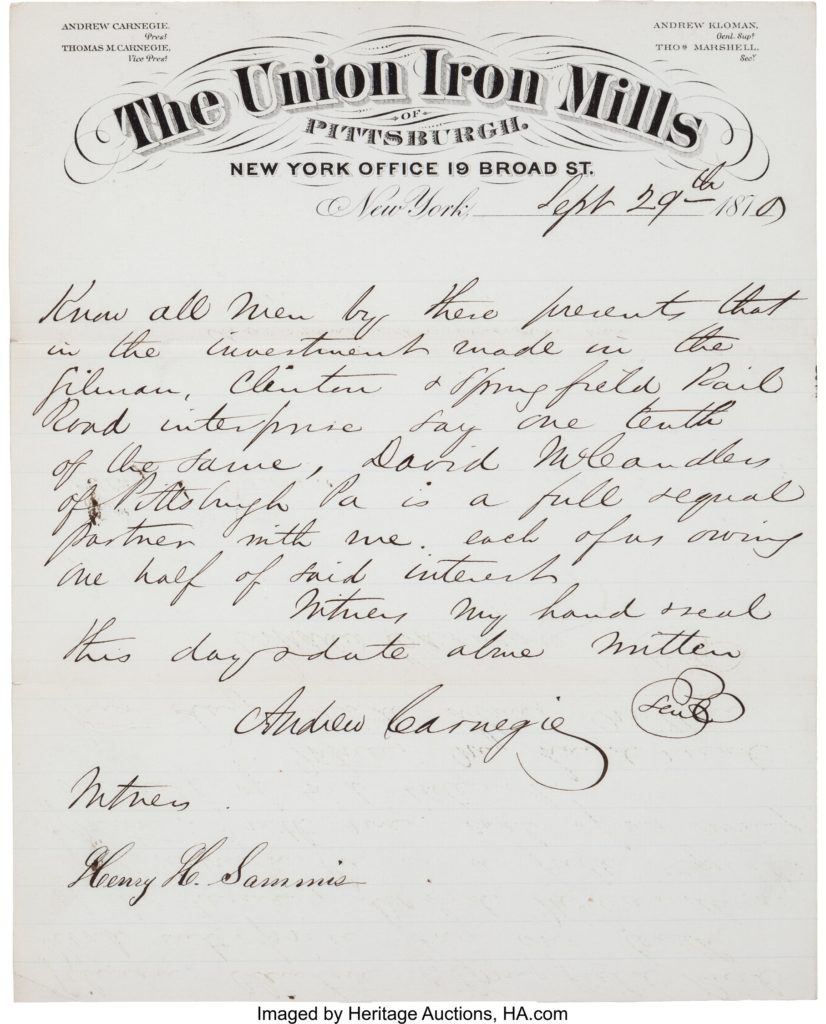

Consider when Andrew Carnegie sold his Carnegie Steel Company to J.P. Morgan in 1901 for an astounding $303 million. He became the richest man in America, surpassing even John D. Rockefeller for several years. JPM then merged it with two other steel companies to form the first billion-dollar U.S. company, U.S. Steel. While Rockefeller continued to expand his oil monopoly, Carnegie devoted the last 18 years of his life to large-scale philanthropy. He literally lived by his credo: “The man who dies rich dies disgraced.” President Teddy Roosevelt would lead the trust-busting that became necessary.

Tim Cook, Mark Zuckerberg, the Google gang and Jeff Bezos would be wise to heed George Santayana’s aphorism: “Those who cannot remember the past are condemned to repeat it.” Especially when social media becomes more addictive than crack cocaine.

Intelligent Collector blogger JIM O’NEAL is an avid collector and history buff. He is president and CEO of Frito-Lay International [retired] and earlier served as chair and CEO of PepsiCo Restaurants International [KFC Pizza Hut and Taco Bell].

Intelligent Collector blogger JIM O’NEAL is an avid collector and history buff. He is president and CEO of Frito-Lay International [retired] and earlier served as chair and CEO of PepsiCo Restaurants International [KFC Pizza Hut and Taco Bell].