By Jim O’Neal

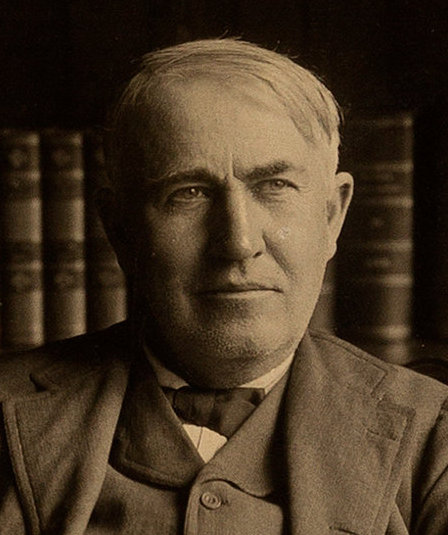

On Monday, Oct. 21, 1929, the Edison Institute was dedicated in Dearborn, Mich. It was to commemorate the 50th anniversary of the first incandescent light bulb that Thomas Alva Edison had invented and the strong friendship between Henry Ford and Edison. Although it was a relatively small group that joined in, it was loaded with luminaries: John D. Rockefeller, Orville Wright, Will Rogers, Marie Curie and, of course, Henry Ford and Edison, who was 82 years old.

President Herbert Hoover’s speech stated: “Every American owes a debt to him. It is not alone a debt for great benefactions he has brought to mankind, but also a debt for the honor he has brought to our country. His life gives confidence … our institutions hold open the door of opportunity … to all that would enter.” The ceremony was broadcast on radio and listeners were asked to keep all their electric lights off until a switch was flipped at the event.

One week later, the stock market was in a state of chaos as a series of events led to the Great Depression.

Ford (1863-1947) had grown up on a rural farm in Michigan and, like virtually every other American, was captivated by the remarkable inventions Edison was cranking out. Eschewing farm work after his mother died, he inevitably went to work at his hero’s company – Edison Illuminating Company – as an engineer.

Ford rose through the ranks to Chief Engineer, which allowed him more personal time to work on developing his version of an automobile. In 1896, at age 33, Ford developed his first experimental car, called the Ford Quadricycle. Edison had been working on an electric car and when the two men finally met, Edison reputedly slammed his fist on a table and exclaimed, “Young man, you have it!” He encouraged Ford to continue his development and this started a longtime friendship between the two geniuses.

Ford eventually developed his Model T, a series of improvements (not inventions) to the combustion engine, and a continuous assembly line. Introduced in 1908, the Model T would be extremely successful, eventually becoming one of the top-selling cars of all time. With the steering wheel on the left side, it is estimated that over 75 percent of everyone who learned to drive did it in some version of the Model T.

Along the way, Ford pioneered the eight-hour workday, reduced the cost from $850 and raised worker wages to $5 a day so they could afford to buy a car. He became a rich and successful businessman with a passion for collecting historic objects. President Wilson convinced him to run for the Senate since he was for peace and a Democrat, but he lost. After his death in 1947, the Edison Institute was renamed the Henry Ford Museum.

Today, the Henry Ford Museum of American Innovation includes Greenfield Village, a tour of the massive Ford Rouge factory, and even a dedicated IMAX theater. The museum has an astonishing collection of Americana, with over 200 cars, JFK’s limousine from his trip to Dallas, the bus Rosa Parks made famous, Lincoln’s rocking chair from Ford’s Theater, Edison’s laboratory, the Wright Brothers’ bicycle machine shop, steam engines and other historic items depicting the history of America.

The Henry Ford Museum is the largest indoor/outdoor museum in the United States, with over 1.7 million visitors a year. Somewhere in this vast collection of truly famous objects is a small test tube with Edison’s last dying breath. Ford convinced Edison’s son to hold a mask over Edison as he was dying and capture/cork the “last breath.” Whether it does or not is irrelevant. The fact is that there are a number of similar test tubes that were filled in the room when Edison actually did die. The Ford example represents the genuine friendship between these two remarkable men and the wheelchair races on their adjoining estates in Florida, the hunting trips that included Harvey Firestone and President Harding, and their quest for knowledge that makes our lifestyle so much better even today.

They were both deeply flawed men who have slowly melted into history, but President Hoover was right. We do owe them a debt a gratitude and can overlook some or most of their egregious sins as the famous door of opportunity is still wide open, as we see every day.

Intelligent Collector blogger JIM O’NEAL is an avid collector and history buff. He is president and CEO of Frito-Lay International [retired] and earlier served as chair and CEO of PepsiCo Restaurants International [KFC Pizza Hut and Taco Bell].

Intelligent Collector blogger JIM O’NEAL is an avid collector and history buff. He is president and CEO of Frito-Lay International [retired] and earlier served as chair and CEO of PepsiCo Restaurants International [KFC Pizza Hut and Taco Bell].