By Jim O’Neal

Conventional wisdom suggests that greatness did not come easily or immediately to the venerable New Yorker magazine. Founded in February 1925, its primary strengths were zeal and enthusiasm, derived primarily from editor Harold Ross. He had journalism in his blood and would be editor for every copy (1,339 issues) until his death in 1951.

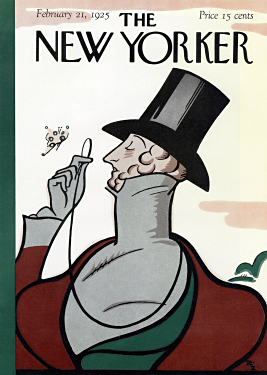

Then there was the critical financial indulgence of principal backer Raoul H. Fleischmann, who founded the General Baking Company. Ross and Fleischmann formed F-R Publishing Company to publish the new magazine. Fleischmann was widely quoted as saying, “The very best thing about the first issue was the cover” – a Knickerbocker dandy (by Rea Irvin) peering through a monocle at a butterfly. Later named Eustace Tilley, the New Yorker dandy became a well-known icon.

The magazine “stank,” Fleischmann pronounced. That first year was dangerously precarious. By the fourth month of publication, circulation had plummeted from a robust 15,000 to a mere 4,000 … with a measly three to four pages of ads. Fleischmann reluctantly agreed to prop it up financially through the summer, and by the fall, it had stabilized … barely.

But timing was favorable since New York – at least during Prohibition years – was at the peak of its gaudiest best. American writing, graphic art and musical comedy were especially lively. Soon, a host of bright, talented writers were attracted to this unconventional weekly publication. Some were already established names, like Robert Benchley and Ralph Barton, while others made the risky leap from ad agencies in the hope it was something more exciting than writing ad copy.

Gradually, the magazine morphed into a curious, almost schizophrenic publication, with parts of The New Yorker getting lighter and funnier, while its fiction, reporting and poetry got more serious. Ross banished sex in any form and scrutinized every sentence for off-color jokes and double entendres. He scrubbed the advertising to ensure it was suitable and disliked fatalistic or socially conscious pieces since they were inevitably too grim.

He was the quintessential editor who kept the copy clear and concise. In his opinion, Harry Houdini and Sherlock Holmes were the only two people in the English-speaking world everyone knew. Any lesser-known, marginal characters were quickly dispatched with a red line. Come back when they’re famous!

Well known for his extreme use of commas, one saving grace was that Ross was a true original member of the Algonquin Round Table, a group of writers, critics and actors who gathered daily for lunch to amuse each other with razor-sharp wisecracks and witticisms. Ross used his contacts with this group to help leverage the magazine since many had national newspaper columns. Also known as “The Vicious Circle,” especially after a few rounds of martinis, they delighted in sharpening their tongues. For example, someone would say “Calvin Coolidge died” and poet/satirist Dorothy Parker would respond, “How could they tell?” Or the comment about a famous actress’ theatrical performance: “Her emotions ran the full gamut from A to B.”

The group was a perfect complement to the magazine and New York’s classic elitism and charming sarcasm. In fact, a prospectus brochure announced (proudly) that it was not edited for old ladies in Dubuque. It was New York snobbery at its best (worst?).

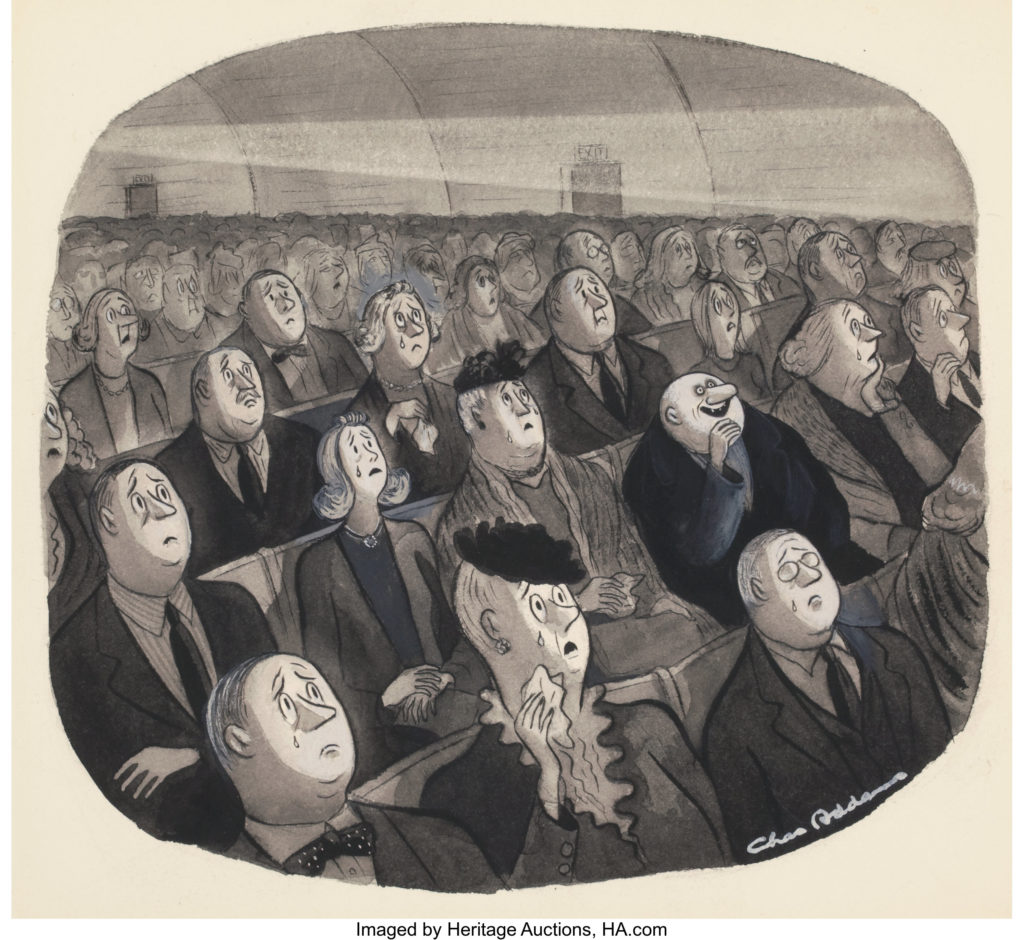

Cartoonists Peter Arno and Helen Hokinson became regulars that first season and added to its reputation of “cosmopolitan sophistication.” One 1928 cartoon shows a mother telling her daughter, “It’s broccoli, dear” and the daughter responds, “I say it’s spinach and I say the hell with it!” (“I say the hell with it” became a common catchphrase and inspired a Broadway song by Irving Berlin). But perhaps the most reprinted cartoon in history is Peter Steiner’s 1993 gag: a drawing of two dogs at a computer with one saying, “On the Internet, nobody knows you’re a dog.”

On the serious side, after WWII, John Hershey penned a 31,000-word article in 1946 titled “Hiroshima.” It deftly conveyed the cataclysmic narrative of the 130,000 people killed through the stories of six survivors coping with the bomb’s aftermath. It was a publishing sensation and the questions it raised about humanity languish yet today. It has been called the most celebrated piece of journalism to come out of the war. This is exactly what Ross wanted. He dedicated nearly the entire issue to the article – a first for the magazine.

Another highly controversial coup was “The Lottery” by Shirley Jackson on June 6, 1948, which told a morbid, dark tale of a small town that conducts a bizarre ritual each year. It is often ranked as the most famous short story in the history of American literature (you’ll have to Google it).

Now, David Remnick, the fifth editor (starting in 1998), calmly leads the magazine to an uncertain future. The New Yorker has become the nation’s most honored magazine, with numerous National Magazine Awards and Pulitzer Prizes. Remnick’s personal awards are impressive and he has authored six important books. The New Yorker is not only the best general magazine, but perhaps the best magazine America has ever produced. At age 94, some say without it, everyone’s sights would be lower.

You decide.

Intelligent Collector blogger JIM O’NEAL is an avid collector and history buff. He is president and CEO of Frito-Lay International [retired] and earlier served as chair and CEO of PepsiCo Restaurants International [KFC Pizza Hut and Taco Bell].

Intelligent Collector blogger JIM O’NEAL is an avid collector and history buff. He is president and CEO of Frito-Lay International [retired] and earlier served as chair and CEO of PepsiCo Restaurants International [KFC Pizza Hut and Taco Bell].