By Jim O’Neal

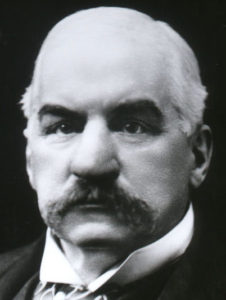

John Pierpont “J.P.” Morgan may have been the preeminent U.S. banker in the last half of the 19th century. He was born in 1837, avoided serving in the Civil War by paying a substitute the traditional $300 to take his place, and started his banking career … first in London with his father and then in New York City. In addition to becoming a famous financier, he accumulated a world-class art and precious gem collection.

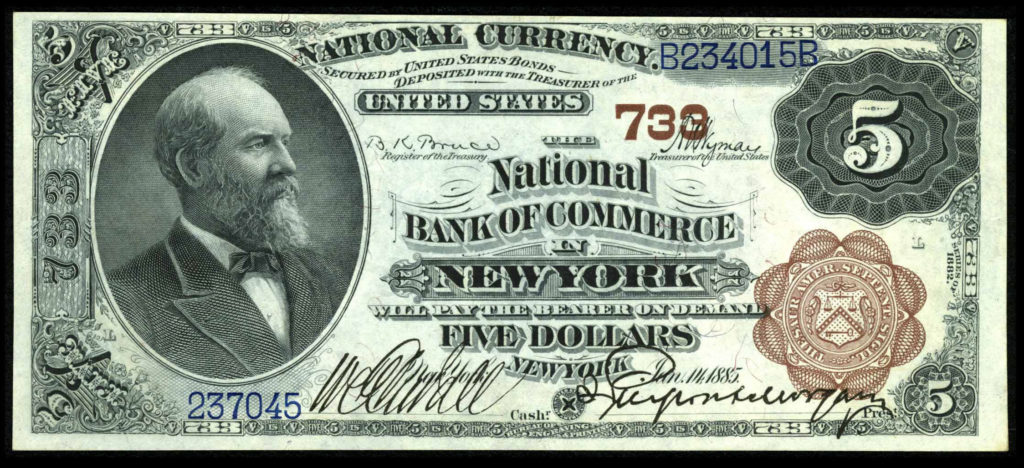

It is his role in helping finance the development of the United States that provides the most interest. In fact, throughout the entire span of his lengthy financial career, there was a chronic lack of capital in the United States to fund economic development. This was primarily due to the lack of a strong national bank or a system to monitor monetary policy and ensure adequate liquidity … without triggering runaway inflation.

This situation was exacerbated by a series of “financial panics” that seemed to occur with regularity every 15 to 20 years due to myriad factors (e.g. bank failures, speculative bubbles, asset-liability mismatches, over-leverage, economic recessions, depressions, etc.). The United States had several in the 19th and 20th centuries and we almost collapsed the entire financial system in 2007-08 after the bursting of the housing bubble and too much bank leverage using exotic products. Central bankers around the world are still struggling with economic development while sovereign governments abdicate their fiscal responsibility.

During Morgan’s career, there was also the issue associated with European investors being skittish about investments in America that were hard to monitor from 3,000 miles away. This was especially true for railroads that were enormously capital intensive. This void created a perfect role for Morgan in New York and his father in London. They could match up sound investments in the United States with eager foreign investors by taking “moral responsibility” (their term) for overseeing their clients’ investment through their bank.

If a railroad went bankrupt, J.P. would personally step in and take charge by managing the bankruptcy, replacing top management, restructuring the financing, installing a new board (often including himself) and staying until the company’s health was restored. This reorganization of railroads came to be called “Morganization.”

Once the essential railroad structure of America had been knitted together into a sound economic and geographic sector, he then turned his talent to industrial organizations. He put together the first billion-dollar corporation by combining several small steel companies with Carnegie Steel and creating U.S. Steel. Next was Edison Electric and Thomson-Houston to form General Electric, one of the original 12 Dow Jones companies.

He and his partners put together International Harvester, financed AT&T, bailed out the U.S. Treasury when they were about to run out of gold during the 1893 Panic, and almost single-handily stopped the Panic of 1907. In this case, he was a national hero, but within a short period many Americans were horrified that one private citizen had so much power. This led to a national monetary commission and eventually the Federal Reserve System of today.

When J.P. Morgan died in 1913 and billionaire John D. Rockefeller read in The New York Times that his estate was only worth $80 million, Rockefeller reportedly shook his head and said, “And to think, he wasn’t even a rich man!”

Intelligent Collector blogger JIM O’NEAL is an avid collector and history buff. He is President and CEO of Frito-Lay International [retired] and earlier served as Chairman and CEO of PepsiCo Restaurants International [KFC Pizza Hut and Taco Bell].

Intelligent Collector blogger JIM O’NEAL is an avid collector and history buff. He is President and CEO of Frito-Lay International [retired] and earlier served as Chairman and CEO of PepsiCo Restaurants International [KFC Pizza Hut and Taco Bell].