By Jim O’Neal

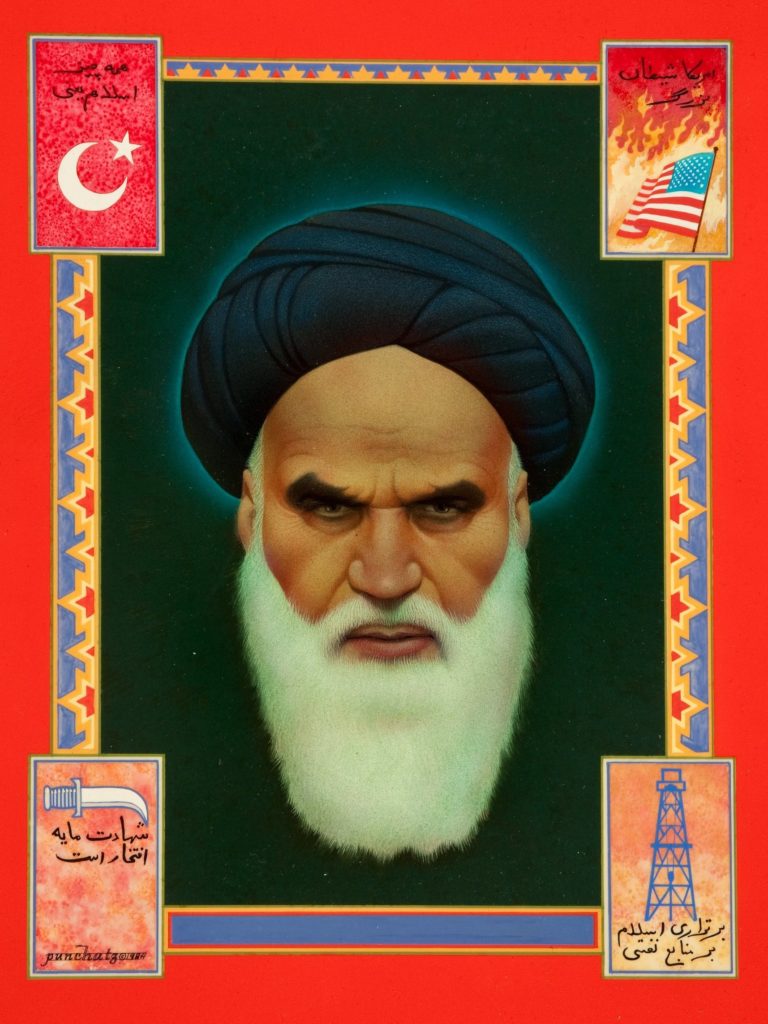

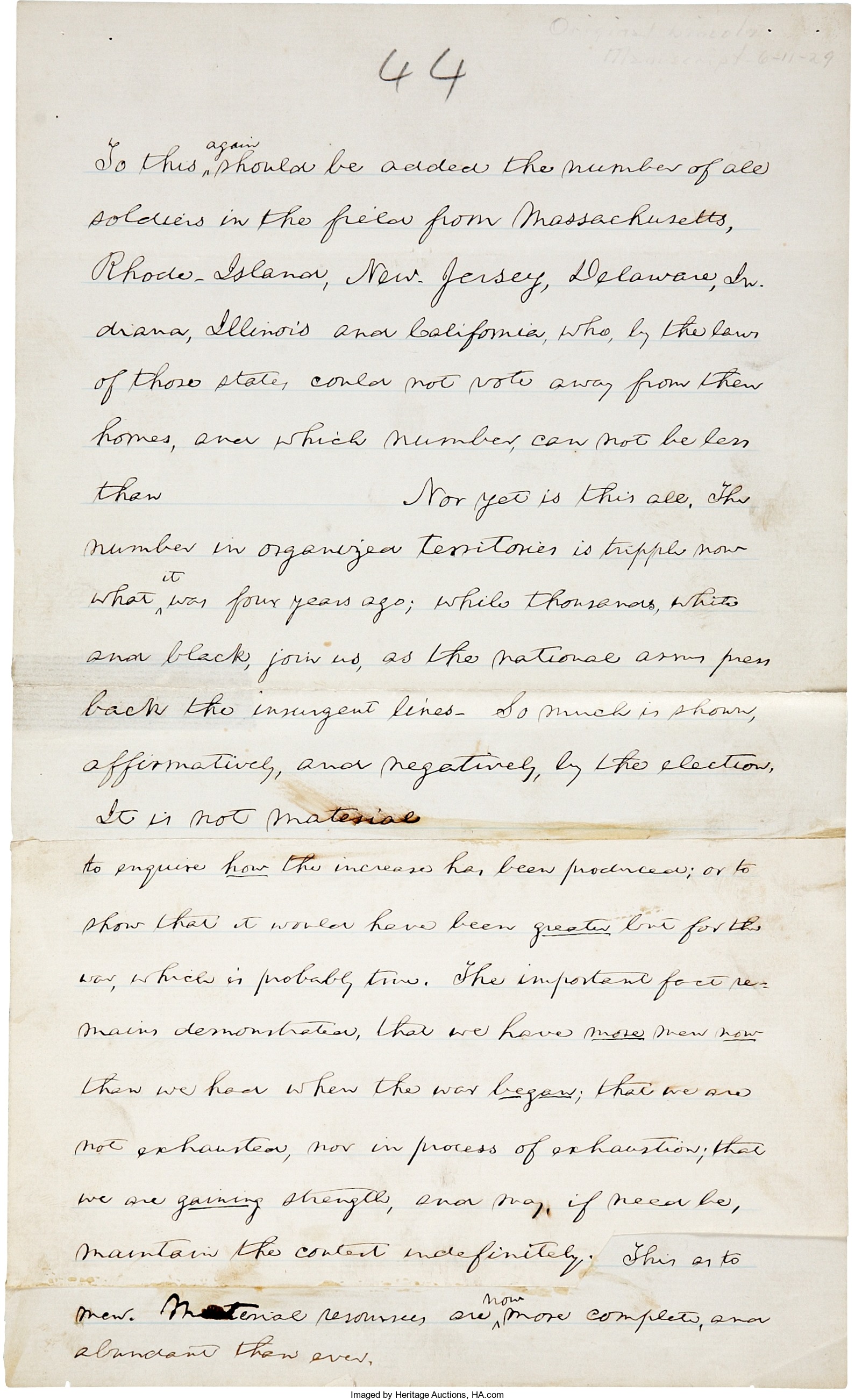

People of my generation recall the 1970s as a decade of chronic financial instability. A lethal combination of rising inflation, slower growth and unpredictable economic policies resulted in a level of volatility that made the stock market a tricky place to navigate. Although the Dow Jones Industrial Average had closed near $1,000 in 1966, it went sideways for the next 17 years. 1972 produced a boomlet for “Nifty Fifty” stock prices that was followed by a steep decline. By spring 1980, the Dow Jones was back below $800.

Risk-averse investors piled into Money Market Funds (MMF) with high yields and low risk. Ross Perot supposedly bought $1 billion of 30-year Treasury Notes and locked in a 15 percent yield. Others chose to speculate in commodities or precious metals as a hedge against the pernicious effects of high inflation. President Ford waged a war on inflation with his WIN (Whip Inflation Now) program that was more of a slogan than a tangible set of financial policies. Cash was something to convert into tangible assets before it lost its buying power.

One prominent example in 1978 was the wife of the governor of Arkansas. The future first lady turned a modest bankroll of $1,000 into $100,000 in 10 short months by trading in cattle futures, soybeans and live hogs. She explained her market prowess was due to reading The Wall Street Journal. Perhaps even more remarkable was that her trades were mostly “shorts” at a time when cattle prices doubled.

But all commodities were generally on the rise and after the Soviets invaded Afghanistan in 1979, the price of gold rose to $875 an ounce. Nelson Bunker Hunt and his brothers tried to corner the silver market and bought control of 200 million ounces – equivalent to 50 percent of the world’s supply. In the process, silver prices shot up tenfold to $50. The Commodities Exchange (COMEX) and the Federal Reserve stepped in and changed the rules and the price quickly plummeted to $10 in March 1980. Despite losing over a billion dollars, they seemed to be mildly amused and still ended up in Johnny’s BBQ for the usual. Later, they were forced into bankruptcy, but a lot of silverware in Dallas homes got melted down, along with jewelry, teapots and other silver-based objects.

I lost a $20 gold coin when gold was at $430 and I bet it would fall to $400 before it hit $500. I had won it on a different bet by knowing a horse had to run 3 15/16th miles to win the Triple Crown. The Wall Street Journal was not involved in either case.

Then the 1980s gave way to the rise of the professional market trader after several leading investment banks had gone public; transforming cautious partners with limited capital to anonymously secret shareholders with large capital resources. “Proprietary Trading” produced quick profits and large bonuses that offset the elimination of fixed commissions by the NYSE. The flashy trader became a symbol of Wall Street – “Masters of the Universe” as chronicled in Tom Wolfe’s The Bonfire of the Vanities. It was now the era of greed and it became an international phenomenon as deregulation and globalization exploded.

Capital whirled around the globe in 24-hour trading and the remnants of conservatism from the Great Depression had quietly vanished. Debt was now viewed as a tax-efficient way to finance corporate takeovers and deregulation replaced supervision. Hedge funds and private partnerships proliferated like George Soros’ Quantum Fund, which generated 25 percent returns with highly leveraged bets on stocks, currency or “risk arbitrage.” In summer 1982, the Federal Reserve reduced the discount rate and incentivized the leveraged buyouts of public companies (LBO).

Falling interest rates and rising stock prices created a perfect setting for “junk bonds” and leverage became a strategy rather than a risk. Eventually it relied on trading on illegal proprietary insider information. Corporate raiders had a field day until 1986, when Ivan Boesky was arrested and the action moved to the federal courts. Naturally, the virus spread into the large home mortgage market and the savings and loan bubble collapsed.

It took a while for a new generation of greedy financiers to come along, and this time the leverage almost took down the world’s financial system in 2008.

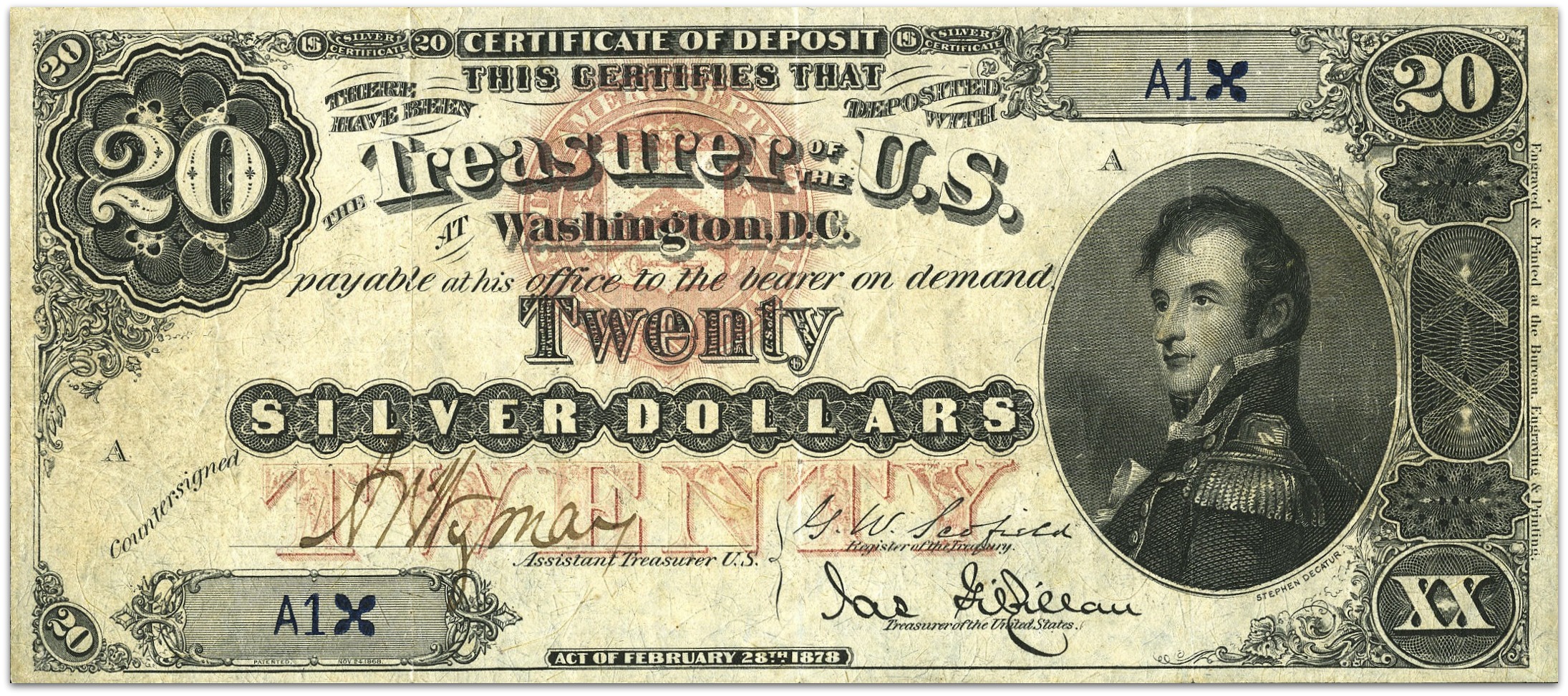

Philosopher George Santayana was right: “Those who do not remember the past are condemned to repeat it.” What’s in your wallet?

Intelligent Collector blogger JIM O’NEAL is an avid collector and history buff. He is president and CEO of Frito-Lay International [retired] and earlier served as chair and CEO of PepsiCo Restaurants International [KFC Pizza Hut and Taco Bell].

Intelligent Collector blogger JIM O’NEAL is an avid collector and history buff. He is president and CEO of Frito-Lay International [retired] and earlier served as chair and CEO of PepsiCo Restaurants International [KFC Pizza Hut and Taco Bell].