By Jim O’Neal

In 1961, I was a member of a high-powered bowling team that competed on Tuesday nights at the South Gate Bowling Center in Southern California. We all had 200-plus averages, but only managed to win one league championship in the four years we were together. In February, one of my teammates, Carl Belcher, bowled a perfect game (12 strikes) and received 250 silver dollars from a promotional gimmick the arena used to attract customers. Nobody paid much attention and I personally thought it was an unnecessary inconvenience to lug the sacks to a local bank to get rid of them.

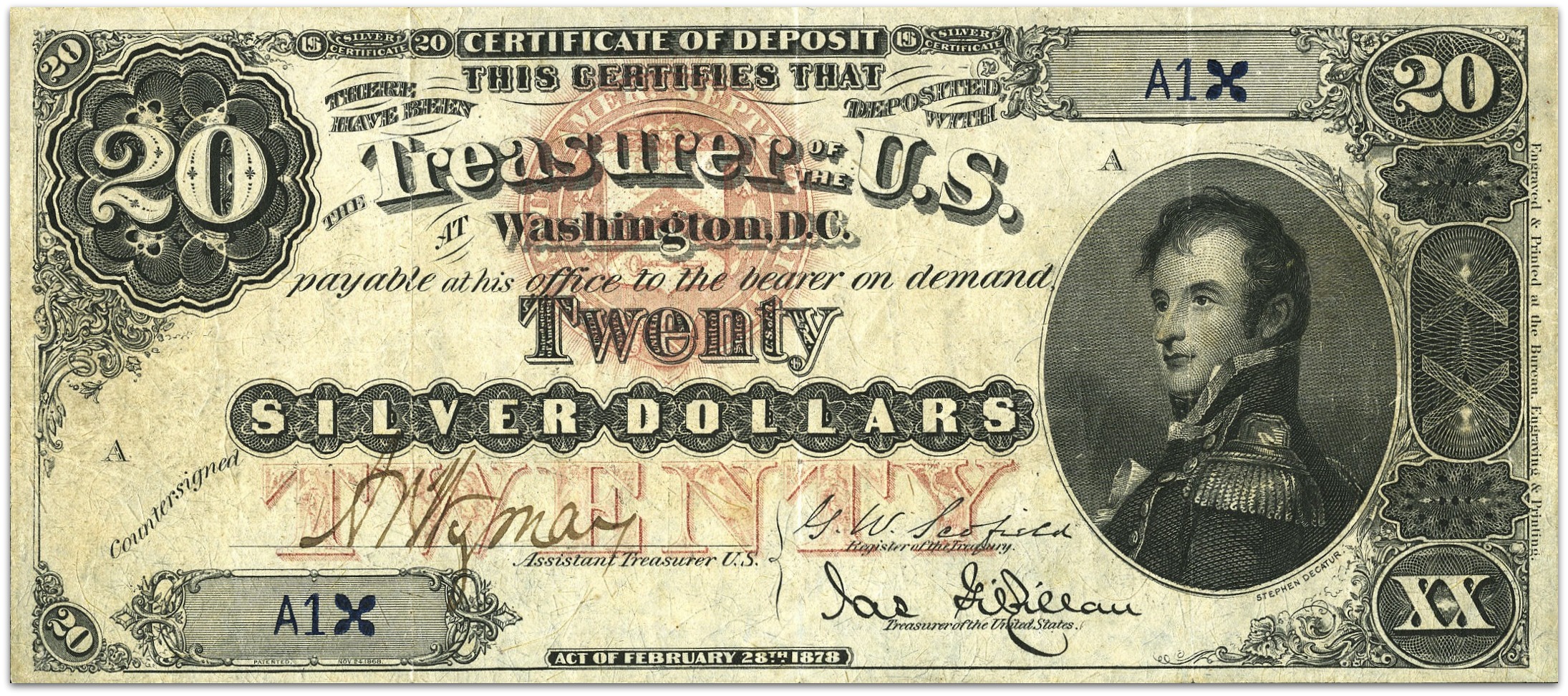

Most of the silver dollars in circulation were probably in Nevada since all the Reno and Las Vegas casino slot machines used them instead of tokens. Even paper currency was printed with the promise to “pay to the bearer on demand … one silver dollar,” which evolved into “one dollar in silver.” For a while, it was possible to get a small plastic bag of silver equivalent to the denomination of the paper currency.

Silver certificates were authorized by two Acts of Congress. The first on Feb. 28, 1878, followed by another on Aug. 9, 1886. These notes are particularly attractive, quite rare and sometimes expensive. At one time, I owned an especially distinguished $20 bill with the head of Captain Stephen Decatur, naval hero of the War of 1812. It was serial number 1 and experts believe that since the Treasury generally printed the $20s first, this note was probably the first silver certificate ever printed. Heritage Auctions auctioned it in 2005 for $175,000 when I sold my currency collection.

However, after Executive Order 6102 of 1933, there were no more gold coins or silver dollars minted in the United States and paper notes were used for denominations above 50 cents. Up to 1964, dimes, quarters and half dollars were minted in 90 percent silver, and half dollars contained 40 percent silver from 1965-70. Even the lowly penny had most of its copper content removed and is now made primarily of zinc, with a thin copper plating.

For 4,000 years, the only period in which civilization has not based its currency on metal, especially gold and silver, is the past 46 years. On Aug. 15, 1971 (“A date that has lived in infamy”), President Richard Nixon announced the temporary suspension of dollars into gold. The White House tapes from the previous week reveal that he thought gold prices would explode after being de-linked since the Federal Reserve would print money like crazy once the currency was not collateralized and this overprinting would affect jobs (unemployment had just gone from 4 percent to 6 percent). And Nixon was “not about to be a hero” (his words) on inflation at the expense of employment.

Then the administration imposed a rigorous regime of wage and price controls, enforced by IRS audits and leverage over federal contracts. The plan failed spectacularly and the 1970s were rife with double-digit inflation, energy shortages and ultimately the “stagflation” that torpedoed both the Ford and Carter presidencies.

Flash forward to today as we are still trying to use monetary policy to solve economic issues and unwilling to even touch the critical fiscal issues that are fundamental to the future economic challenges everyone acknowledges. The only thing that has changed is that there is no need to actually print money when it can be “whistled into existence” via monetary legerdemain called quantitative easing, where the Federal Reserve loans money to the Treasury Department.

Since the financial crisis of 2008, the world’s central bankers have materialized $12.25 trillion by tapping on a computer keyboard. For perspective, the value of all the gold that’s ever been mined, according to the World Gold Council, is a mere $7.4 trillion. The historical linkage between the value of our money and its metal content is a quaint relic of the past.

Intelligent Collector blogger JIM O’NEAL is an avid collector and history buff. He is president and CEO of Frito-Lay International [retired] and earlier served as chair and CEO of PepsiCo Restaurants International [KFC Pizza Hut and Taco Bell].

Intelligent Collector blogger JIM O’NEAL is an avid collector and history buff. He is president and CEO of Frito-Lay International [retired] and earlier served as chair and CEO of PepsiCo Restaurants International [KFC Pizza Hut and Taco Bell].