By Jim O’Neal

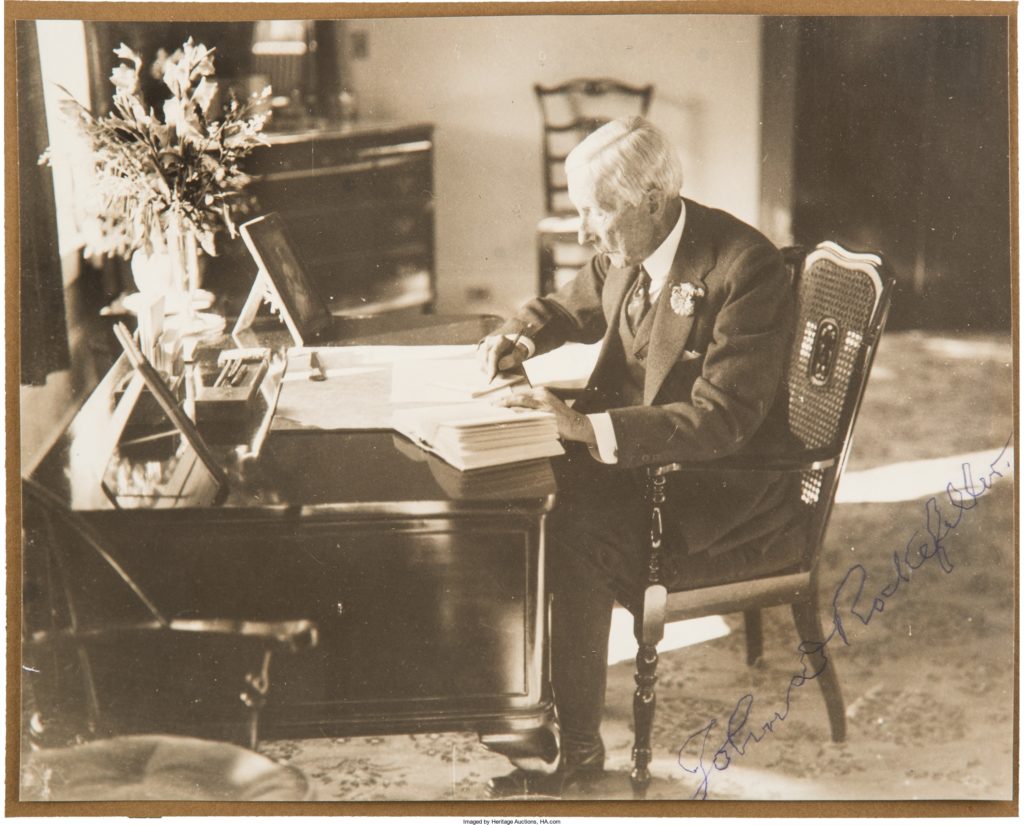

Few people who were alive when Martin Van Buren was president (1837-41) were still alive when Franklin Delano Roosevelt was inaugurated for his second term (1937). John Davison Rockefeller was, and he took advantage of every single day, even preferring to work on his many birthdays.

Were he still alive, it’s almost certain he would be mildly amused to see a modern company – AT&T – seeking approval from a government department for an $85.4 billion acquisition of media giant Time Warner. In 1974, this same agency – the U.S. Department of Justice – filed an anti-trust lawsuit against AT&T. Eight years later, “Ma Bell” was forced to break up by spinning off seven “Baby Bells.”

Perversely, one of these spinoffs, SBC Communications (named Southwestern Bell Corporation until 1995) started methodically reconsolidating and eventually bought the original AT&T and assumed its name. Next, they acquired BellSouth for $85.5 billion, with full FCC approval.

Big ’ins always eat little ’ins (old Texas maxim).

John D. Rockefeller became the world’s richest person (ever) in a similar fashion: consolidating an industry to avoid competition.

The great industrial revolution that transformed America after the Civil War sparked an inflationary boom that resulted in an oversupply of goods. Naturally, this led to price declines that caused a deflationary spiral. The balance of the 19th century was plagued by these boom-bust cycles. As new markets developed, inexperienced businessmen failed to recognize the dangers of supply-demand imbalances as they rushed to make their fortunes.

Crude oil was a classic example, since there was no way to predict increases in supply, and oil refiners proliferated due to low barriers to entry. “So many wells were flowing, the price of oil kept falling, yet they went right on drilling.” Rockefeller was one of the first to recognize there was a need for a systemic solution. He cited the years of 1869-1870 as the start of his campaign to replace competition with “cooperation.”

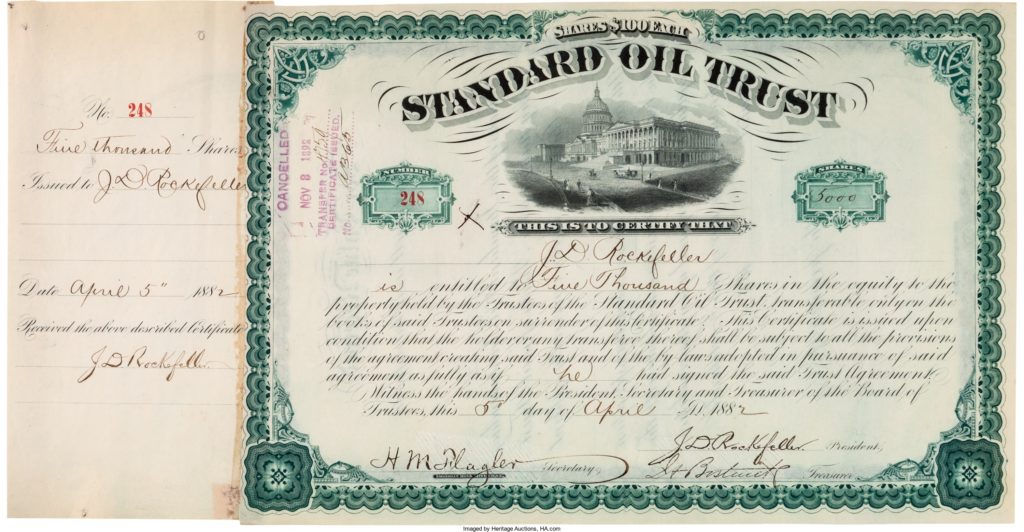

By the early 1880s, his Standard Oil Company controlled 90 percent of U.S. refineries and pipelines. In 1882, his clever lawyers created an innovative new kind of corporation that controlled all of the holdings in a “trust.” The trust controlled over 40 companies and it became easy to control production, distribution and refining (and, obviously, prices).

In 1911, the Supreme Court ruled these were illegal monopoly practices and ordered that it be broken up into 34 new companies. In a twist, John D. Rockefeller ended up with stock in all 34 companies, and over the next 10 years their combined net worth increased fivefold, as did Rockefeller’s personal fortune. Today, ExxonMobil Corporation is the largest of the world’s Big Oil companies and is consistently among the top five companies in revenue and profits.

The Greeks had a myth about Hydra, a multi-headed monster that grew two heads every time one was cut off. You can draw your own parallels.

Intelligent Collector blogger JIM O’NEAL is an avid collector and history buff. He is president and CEO of Frito-Lay International [retired] and earlier served as chairman and CEO of PepsiCo Restaurants International [KFC Pizza Hut and Taco Bell].

Intelligent Collector blogger JIM O’NEAL is an avid collector and history buff. He is president and CEO of Frito-Lay International [retired] and earlier served as chairman and CEO of PepsiCo Restaurants International [KFC Pizza Hut and Taco Bell].