By Jim O’Neal

Next year promises to be another year when a major political party has an unusually large number (perhaps 20) of eager aspirants wanting to become president. Republicans had to contend with a similar problem in 2016. Sixteen hopefuls filled out the requisite forms. Most of them withdrew during the primaries and the last two – Ted Cruz and John Kasich – withdrew when Donald Trump won Indiana. On May 2, Trump became the presumptive nominee for Republicans.

There are advantages to having a broad, diverse group of candidates, but almost as many headaches. One that I suspect will become more prominent is “too many hogs at the trough.” Every candidate is challenged to find a unique angle to woo prospective voters, but it is surprising how many are making promises that will be impractical to keep. Free health care, college debt forgiveness, and free college tuition are fundamentally different than promises of lower taxes or new high-paying jobs.

Generally, populist proposals are “paid for” by taxing the rich with a “billionaire tax” or a radical wealth tax on existing assets. Since 70 percent of federal revenues come from the top 20 percent of taxpayers, the math just doesn’t work. This is especially true with 10,000 people retiring every day and existing entitlement projections squeezing out almost all other spending. One fact is certain: We can’t use the same tax dollar to pay for four different expenditures (unless we really crank up the printing presses … which are now just electronic gizmos).

Naturally, opponents are quickly stigmatizing all creative spending proposals as merely different variants of socialism. As “The Iron Lady” Margaret Thatcher wisely observed, “The trouble with Socialism is that eventually you run out of other people’s money.”

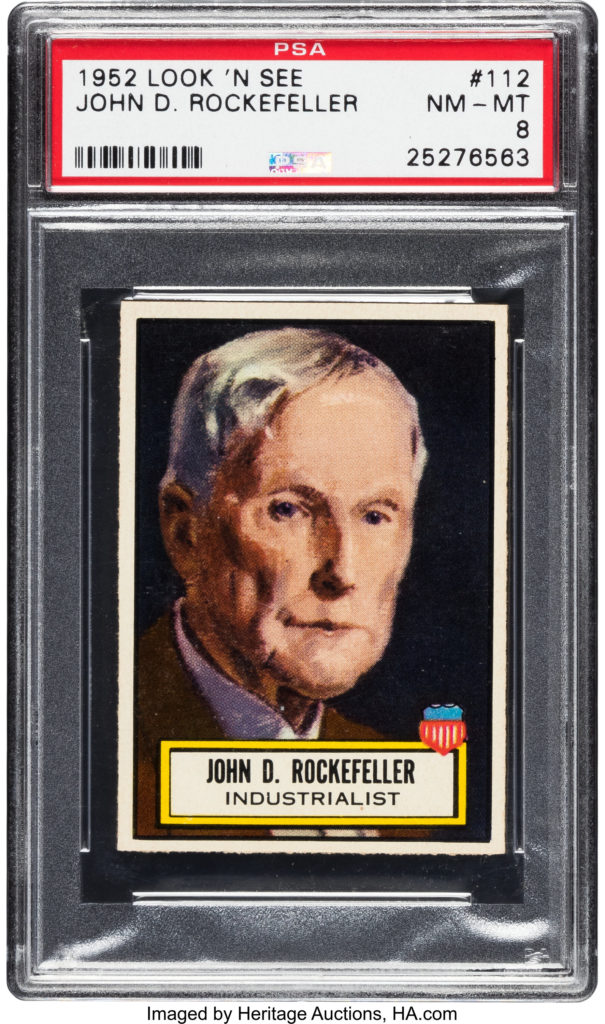

There may have been a time 150 years ago during the Gilded Age when some of these things made sense. America’s industrial success produced an era of financial magnificence when many basked in dynastic wealth of inexhaustible dimensions. John D. Rockefeller made the equivalent of $1 billion and paid no income tax. No one else did either since income tax didn’t exist in the United States at the time. Congress passed a 2 percent tax on earnings over $4,000, but it was ruled unconstitutional by the Supreme Court. Twenty years later in 1914, a modest income tax was finally approved. Albert Einstein said: “The hardest thing in the world to understand is the income tax.” I agree.

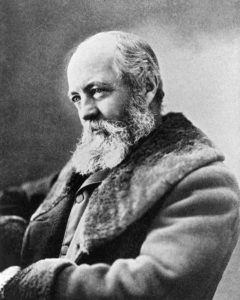

The wealthy in the 19th and 20th centuries found that spending all of their money became a full-time job. After emptying all of Europe’s fine art and artifacts, they built houses on a truly grand scale. The grandest of all were said to be the Vanderbilts. Ten mansions on 5th Avenue (one with 137 rooms). Next was Newport, R.I., where magnificent homes were quaintly called “cottages.” Then came George Washington Vanderbilt II (1862-1914), who, with successful and influential landscape designer Frederick Law Olmsted, built the Biltmore House – an estate outside Ashville, N.C. The house is believed to be the largest domestic dwelling in the United States, with 250 rooms nestled on 125,000 acres.

Olmsted and his senior partner, Calvert Vaux, designed America’s most famous park: New York City’s Central Park. The list of Olmsted’s projects is too extensive to list here even by category. The most fitting description of his work comes from the words of Daniel Burnham – the great American architect and urban designer: “An artist, he paints with lakes and wooded slopes, with lawns and banks and forest-covered hills, with mountainsides and ocean views.”

Worthy of a great man’s epitaph!

Intelligent Collector blogger JIM O’NEAL is an avid collector and history buff. He is president and CEO of Frito-Lay International [retired] and earlier served as chair and CEO of PepsiCo Restaurants International [KFC Pizza Hut and Taco Bell].

Intelligent Collector blogger JIM O’NEAL is an avid collector and history buff. He is president and CEO of Frito-Lay International [retired] and earlier served as chair and CEO of PepsiCo Restaurants International [KFC Pizza Hut and Taco Bell].